About

TO OBTAIN A COPY OF PAYMENTS MADE IN 2025 FOR TAX PURPOSES, PLEASE USE THE LINK BELOW:

https://gemsnt.com/winchester/

https://gemsnt.com/winchester/

ONLINE & PHONE PAYMENTS - To make a tax payment on our online tax payment system, please pay by clicking this link, and follow the instructions. Payment made via a credit card will be assessed a convenience fee by the credit card company. You may also pay via phone by reaching out to a Point and Pay Personal Teller at 877-495-2729 (2PAY), you can now make live agent payments. A $5.00 Personal Teller fee will be applied to the customer transaction, in addition to the normal credit card, debit card, or electronic check convenience fees. Available 8am-11pm EST.

IF YOU NEED IMMEDIATE DMV CLEARANCE – If you require a DMV release, please be advised that online payments typically take up to five (5) business days to clear. If you need to be released at DMV sooner, payment should be made directly in the Tax Office by cash, money order, or cashier’s check.

MOVED OR NO LONGER OWN A VEHICLE? - Please call the Assessor to inquire about an adjustment on your bill at (860) 379-5461.

IF YOU NEED IMMEDIATE DMV CLEARANCE – If you require a DMV release, please be advised that online payments typically take up to five (5) business days to clear. If you need to be released at DMV sooner, payment should be made directly in the Tax Office by cash, money order, or cashier’s check.

MOVED OR NO LONGER OWN A VEHICLE? - Please call the Assessor to inquire about an adjustment on your bill at (860) 379-5461.

ACCOUNT STATUS – Account information can be obtained by utilizing this ONLINE TAX PAYMENT/TAX BILL INQUIRY LINK. Any tax information that is requested to be researched by the tax office must be requested in writing (taxcollector@townofwinchester.org).

ATTORNEY'S LOOKING FOR CLOSING INFORMATION - please contact the Water/Sewer department to schedule a final meter reading at (860) 379-4070 – PLEASE DO NOT TAKE AN AVERAGE FROM PREVIOUS BILLING PERIODS.

Sec. 12-141a. Payment of municipal taxes by credit card. Any municipality may allow the payment of taxes, penalties, interest, and fees by means of a credit card and may charge the taxpayer a service fee for any such payment made by credit card. The fee shall not exceed any charge by the credit card issuer or service provider, including any discount rate. Payments by credit card shall be made at such times and under such conditions as the municipality may prescribe. The debt incurred through the payment of taxes by means of a credit card shall not be considered a tax collectible pursuant to the provisions of section 12-172.

ATTORNEY'S LOOKING FOR CLOSING INFORMATION - please contact the Water/Sewer department to schedule a final meter reading at (860) 379-4070 – PLEASE DO NOT TAKE AN AVERAGE FROM PREVIOUS BILLING PERIODS.

Sec. 12-141a. Payment of municipal taxes by credit card. Any municipality may allow the payment of taxes, penalties, interest, and fees by means of a credit card and may charge the taxpayer a service fee for any such payment made by credit card. The fee shall not exceed any charge by the credit card issuer or service provider, including any discount rate. Payments by credit card shall be made at such times and under such conditions as the municipality may prescribe. The debt incurred through the payment of taxes by means of a credit card shall not be considered a tax collectible pursuant to the provisions of section 12-172.

Meetings

Upcoming

Currently, there are no upcoming meetings posted for this entity.

Recently Held

Aug 1, 2023

Latest News

FAQs

What is the best way to pay my tax bill?

The most convenient way is by mail, or online. To pay online, visit the Revenue Collector’s

home page www.townofwinchester.org/tax- collector. A courtesy reply envelope is included with your tax bill if you wish to mail your tax payment. Write your list numbers on your check. Your list numbers are shown on your payment coupons. If you wish to have a receipt returned to you, please send the “tax payer” portion of your tax bill (both payment coupons) and a self-addressed, stamped envelope with your payment. You will receive a receipt back within a few days. We will not send back your receipt if you do not include a self-addressed, stamped envelope.

You may also come into the office and pay in person. Please be aware that towards the end of a collection period we may be experiencing long lines. There is also a drop box outside the Revenue Office where you can leave your payment. Please do not leave cash payments. You may still drop off payments in the drop box after regular office hours – you can enter Town Hall through the Police Department entrance. The drop box is checked every morning. The Revenue Office is unable to process any credit/debit card payments. Acceptable forms of payment are cash, personal check, money orders, bank check, and certified check.

What happens if I pay late?

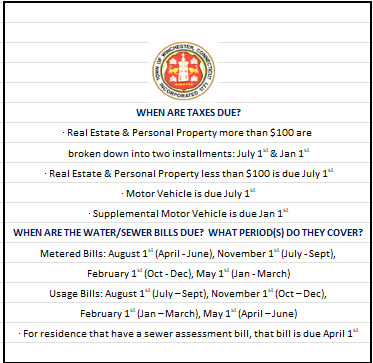

Taxes are due on July 1, payable by August 1, and January 1, payable by February 1. You have a one-month "grace" period in which to pay without penalty, either in person or by mail. The first installment of dual installment real estate and personal property tax bills and sewer use charges in the amount of $100 or more, and motor vehicle taxes in full, are due by August 1.

Past due payments are subject to interest at the rate of one and one-half percent per month from the due date of the tax (July 1 or Jan. 1), as required by state law. Payments received after the last day to pay, including payments postmarked after that date, are past due, and will incur 3% interest, representing two months' delinquency (July & August). Payments legibly postmarked on or before August 1 (first half) or Feb. 1 (second half) are considered timely regardless of when they are received. The town is required by law to accept a legible U.S. Postal Service postmark as the date of payment.

Can I pay with an E-check?

Yes, however please be aware that if an e-check is received after the grace period has expired, interest will be assessed as of the date the payment is received in accordance with Connecticut State Statute 12-146.

Please allow ample time for mail delivery to avoid interest charges since electronic checks are mailed with no US Postmark date to refer to and so be posted as of the date received.

Please allow ample time for mail delivery to avoid interest charges since electronic checks are mailed with no US Postmark date to refer to and so be posted as of the date received.

Why does the envelope with my bill have a Hartford address?

Our bank processes payments through a lockbox service. The correct address for payment is:

Town of Winchester - Dept 334 P.O. Box 150492 Hartford, CT 06115-0492

Lockbox processing is for current bill payments with current payment coupons only. Past due bills and online banking checks set up through your banking institution must be mailed directly to the tax office at:

Town of Winchester – Collector of Revenue 338 Main Street Winsted, CT 06098.

TO INSURE PROPER POSTING OF PAYMENT, PLEASE BE SURE THAT YOU USE THE CURRENT YEAR LIST NUMBER ON YOUR CHECKS WHEN SETTING UP YOUR PAYMENT FROM YOUR ONLINE BANKING SYSTEM.

Please throw away any old envelopes you have with the Boston, MA address to avoid delays/mail returns in future payment processing. Thank you.

Please throw away any old envelopes you have with the Boston, MA address to avoid delays/mail returns in future payment processing. Thank you.

May I pay more than one bill with one check?

Yes, you may all your bills with one check, please reference the list # (noted on your bill) and the check payment.

What if I never received a tax bill?

Failure to receive a tax bill does not exempt you from payment of all taxes and all interest charges. If you do not receive a bill for which you are responsible, call the Revenue Office at (860)379-4474 and request a copy, or go to www.townofwinchester.org and click on the ‘Tax Bill Inquiry/Pay’ feature to view your bill on line, or print a duplicate copy.

Could I be eligible for any exemptions?

Exemption categories include Veteran; Spouse of a deceased Veteran; Blind; Totally Disabled; Motor vehicle of a Serviceman or Servicewoman (active duty); Farmers / Merchants; and Forest, Farm and Open Space. For details, or if you think you qualify, contact the Tax Assessors Office at (860) 379-5461 Veterans’ & other exemptions, if any, appear in the total exemptions (“exempt”) column on your tax statement.

I am being improperly billed for a motor vehicle. What should I do?

Contact the Tax Assessor's Office at (860) 379-5461. Do not ignore your bill! Even if your vehicle has been sold, and plates returned to DMV; stolen and not recovered; declared a total loss; or if you have moved from Winchester/Winsted or moved from Connecticut. If any of these situations applies to you, you may be entitled to a credit. Contact the Tax Assessor regarding the acceptable forms of proof. Two forms of written proof are required, and you must apply within a limited time.

I need to register my car. What do I do?

If you owe delinquent property taxes on any vehicle in your name, you may not renew any registrations at the Department of Motor Vehicles without paying your property taxes first. All past due taxes in your name must be paid in full. If you require an immediate DMV release you will need to remit payment by cash, money order, or certified bank check, in person. Personal checks are held 7 business days before receiving clearance. Online payments take up to 2 days to be received by the Revenue Office, and an additional 5 days to clear at the DMV.

I have moved. What is my tax jurisdiction for motor vehicle taxes?

Your tax town is your town of residency as of October 1 of the Grand List year. If you moved from Winchester/Winsted after October 1 but still resided in Connecticut, you will still pay vehicle taxes to Winchester/Winsted. Municipalities do not apportion motor vehicle tax bills for portions of a tax year. If you registered the vehicle in another state, contact the Tax Assessor's Office. If you move, you are required to notify the Department of Motor Vehicles of your new address within 48 hours. Be sure that you request a change of address on your driver's license and on your vehicle registration(s). Forms for this are available on line at the DMV web site, or at any municipal Police Department.

What is a "supplemental" motor vehicle tax bill?

If you newly registered a motor vehicle after October 1 (first time registration), you will receive a pro-rated tax bill in December payable by February 1. This "supplemental" bill will reflect the time from the month the vehicle was first registered, through September only.

Can the interest on my tax bill be waived?

No. The Collector of Revenue does not have the authority to waive interest and makes no exceptions. As owners of property, taxpayers are responsible to see that taxes are paid when due.

My Account Statement/Demand Letter shows I am being charged interest and other fees. What does that mean?

According to our records, there are past due taxes in your name, or on the parcel of property in question. We try to list all delinquent taxes owed on your Account Statement/Demand letter. Delinquent taxes and interest must be paid in full before payment on current bills can be accepted. Any payment you send in toward your current taxes will be applied to the back taxes.

Are there any breaks for senior citizens?

Yes. If you or your spouse are age 65 or older, permanently reside in Winchester/Winsted (legal residence), either own your own home or rent, and meet certain income restrictions, you may be eligible for one or more forms of city and / or state financed property tax credits and / or tax deferral. For information about these programs, please contact the Tax Assessor's Office at 860-379-5461. You may also inquire in person at the Assessor’s Office at Town Hall.

Do I need to save my receipts?

Yes. Everyone paying at the Revenue Office window will be issued a receipt. Payments left in our drop box will not receive a receipt unless requested, with a stamped addressed envelope. You must retain your own payment information for purposes of claiming tax credits and filling out federal and state income tax forms. You can also look up your payment history on line by clicking the ‘‘Tax Bill Inquiry/Pay’ feature at www.townofwinchester.org.

What period of time does this bill cover?

Motor vehicle and personal property tax bills sent in July and January cover from October 1 through September 30. Personal property tax bills may be due in two installments. There is no statutory rule concerning the time period covered by real estate tax bills. If you buy or sell real estate, adjustments for real estate taxes will be made by the attorneys who are handling the closing of the property. Care should be taken to ensure taxes are paid, particularly when a closing occurs within 60 days of a tax billing.

Where does my veteran’s exemption appear?

If you receive (for example) a veteran’s exemption, an amount will appear in the exemption column on your tax statement. The exemption column will also include any other exemptions you may receive, such as a blindness exemption, etc.

I am owed a refund from the Town of Winchester/City of Winsted. How do I receive my payment?

Any person who pays more than the tax amount due is entitled to a refund in accordance with Connecticut State Statute 12- 129. Refund requests must be received in writing and must include a copy of the paid tax receipt and cancelled check. Please allow 4-6 weeks for your refund to be processed. No refunds are issued under $5.00.

I recently replaced a vehicle, and still got a tax bill on the old vehicle. Do I have to pay it?

Yes. If you replaced one vehicle with another, and used the same license plates, you must pay on the “old” vehicle now. You will receive a pro- rated Supplemental motor vehicle tax bill in December, payable by Feb. 1, for the new vehicle. This bill will reflect a credit for the amount you paid in July, on the old vehicle. You will receive this credit without having to apply for it. You still must pay the entire amount due on the old vehicle in July. However - if you obtained new license plates for the new vehicle, you must apply for a credit. Contact the Tax Assessor’s Office at (860) 379-5461.

Staff & Contacts

Pam Colombie

Assistant Collector of Revenue

860-379-4474

ext.

337

Term:

-

Board Members

Members

Term

No contacts have been found for this entity.

Alternate Members

Term

No contacts have been found for this entity.

Commission Members

Members

Term

No contacts have been found for this entity.

Alternate Members

Term

No contacts have been found for this entity.

Committee Members

Members

Term

No contacts have been found for this entity.

Alternate Members

Term

No contacts have been found for this entity.